How many customer invoices do you process? 500 /month totaling 6000 /year

* on the basis of one page per invoice.

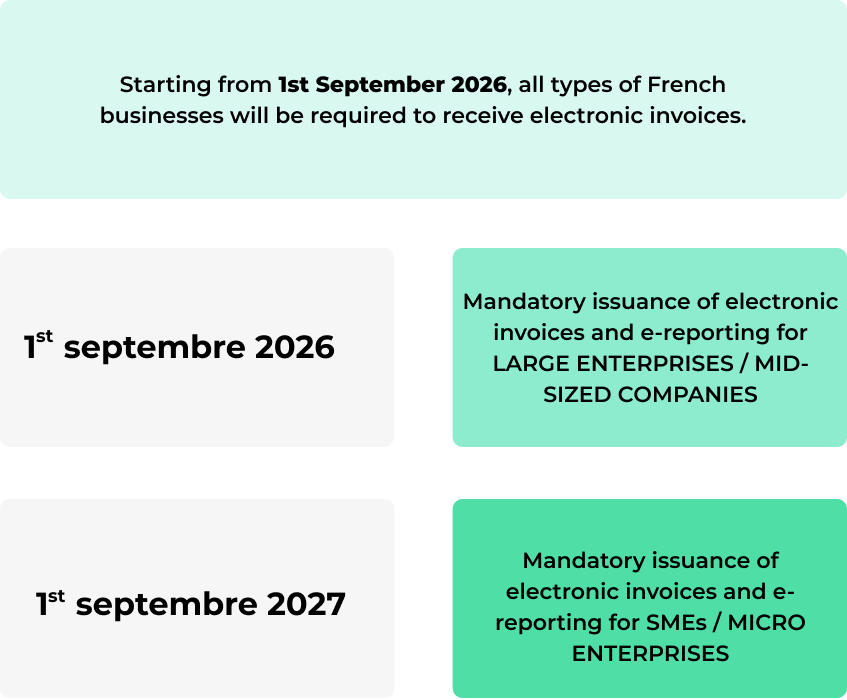

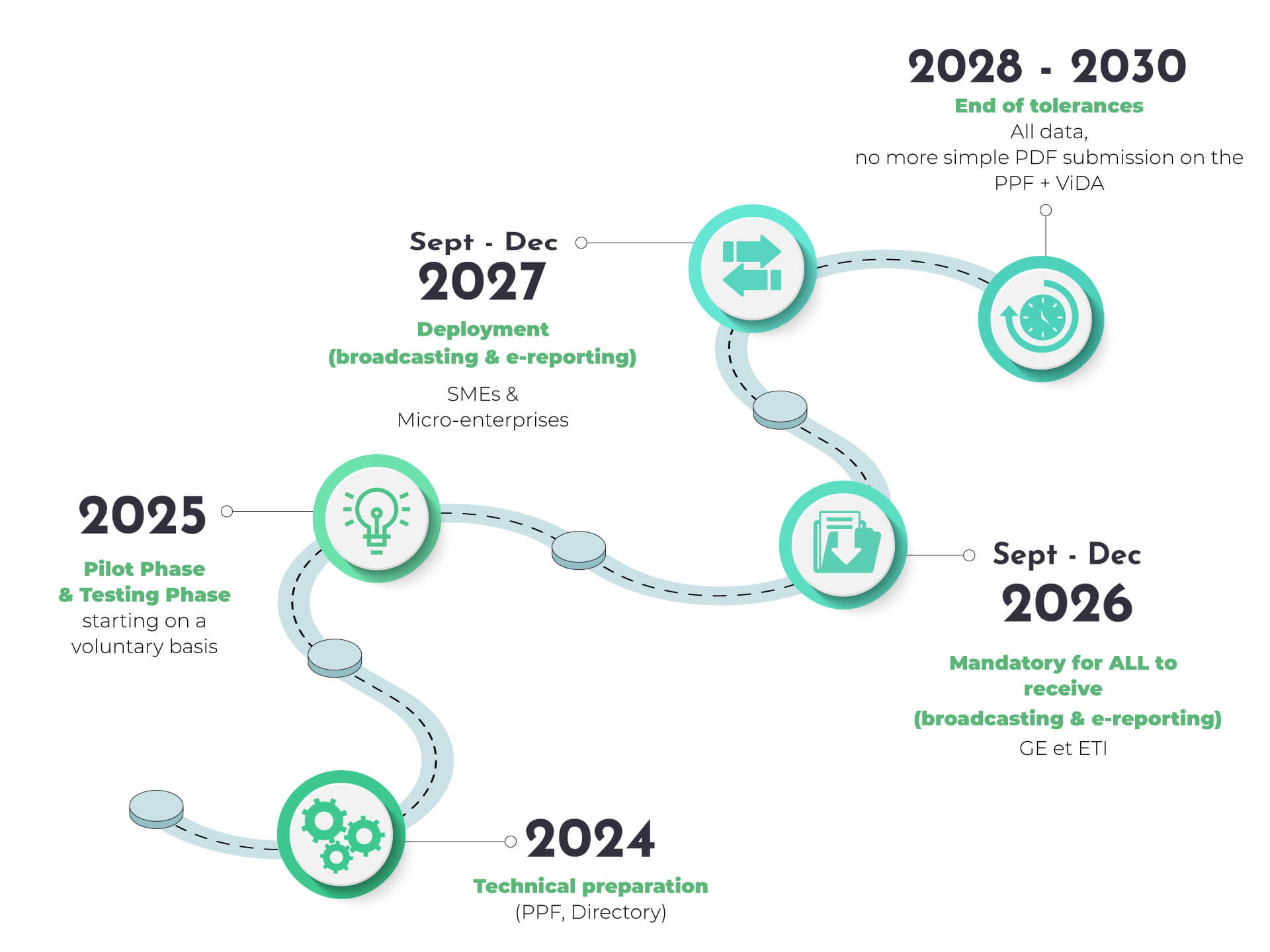

Starting from 1st September 2026, french companies will be required to send and receive electronic invoices. The implementation will be gradual, tailored to the different types of businesses (from Large to Micro Enterprises).

EDT, ISO 27001 certified and registered as a PDP (No. 0058), supports you now and makes your transition to electronic invoicing easier.

With EIMA™ offered by EDT, you can fully digitise your outgoing invoices while complying with all current regulations, bidding farewell to paper!

How many customer invoices do you process? 500 /month totaling 6000 /year

* on the basis of one page per invoice.

Cost (1)

4000 €

Today with invoices

Time spent

500 hours

Cost

1760 €

Tomorrow with EDT

Time spent

50 hours

Cost

2240 €

Your savings

Time saved

450 hours

How many customer invoices do you process? 500 invoices /month totaling 6000 invoices /year

* on the basis of one page per invoice

Cost: 4000 €

Time spent: 500 hours

Cost: 4000 €

Time spent: 500 hours

Cost: 4000 €

Time spent: 500 hours

(1) Estimated annual processing cost of your paper invoices with a processing cost of €8 per paper invoice, according to a report by report by GS1

EIMA™ is an electronic invoice management solution that operates as a Partner Dematerialisation Platform (PDP), a trusted third party of the state for the exchange of electronic invoices from companies subject to French VAT.

A PDP provides essential functionalities for exchanging electronic invoices and offers additional services aimed at automating the end-to-end flow of invoice exchanges, both for issuing and receiving invoices.

The features provided by a PDP include:

In summary, the PDP is at the heart of electronic invoice exchange flows.

EIMA™ is certified by GS1 and declared to the DGFIP

EDT is an active member of associations related to electronic invoicing in France and Europe.

Our Vision

At EDT, we firmly believe that the widespread adoption of electronic invoicing will positively transform the financial management of businesses. By ensuring the automatic and complete transmission of invoices and their data in real time, it will facilitate constant and accurate visibility of a company’s financial situation. Moreover, integrating electronic invoicing into management tools will allow for the full utilisation of this data to automate and optimise all financial processes.

However, this transformation can become complex, particularly due to the proliferation of decentralised transmission platforms, whether public or private. With EIMA™, our registered PDP dematerialisation platform, we provide a solution that significantly simplifies these processes. We ensure that our tools are perfectly tailored to support businesses in the transition to electronic invoicing, eliminating technical obstacles and ensuring full compliance.

Our Commitment

EDT offers a comprehensive service for the issuance, transmission, and centralisation of invoicing flows, in direct connection with the Public Invoicing Portal (PPF). This technological hub ensures the smooth and secure circulation of each invoice, whether towards ERP systems, accounting solutions, or partner platforms. With this approach, the challenges related to data collection and transmission become a thing of the past.

EDT is evolving its solutions today to enable:

In France, all businesses must adopt electronic invoicing by 1st September 2026 for the receipt of invoices and starting in 2027 for issuing invoices, depending on the size of the business.

All businesses subject to VAT, regardless of their sector or size, are affected by electronic invoicing. This includes SMEs, micro-enterprises…

No, from 2026 onwards, sending invoices in paper or PDF format will no longer be compliant. Only electronic invoices issued and transmitted via certified platforms will be accepted.

Non-compliance with electronic invoicing obligations can result in tax penalties, fines, and delays in the processing of VAT returns.

The dematerialisation of invoices relies on the use of certified platforms that enable the secure and compliant issuance, receipt, and archiving of electronic invoices.

EDI (Electronic Data Interchange) is a structured standard that allows for the automated exchange of commercial documents. Electronic invoicing is part of EDI exchanges by relying on more standard formats while complying with the tax obligations of the 2024 Finance Act.

No, electronic invoicing is mandatory only for exchanges between French businesses subject to VAT. If your client is abroad, electronic invoicing is not required, but it is advisable to check the local requirements of the client’s country.

Feel free to ask us your question directly; our experts will be happy to provide you with a personalised response.

EDT a Weexa group company, a human-centered, collaborative, and expert company, is committed to building a sustainable future by offering innovative solutions to its clients and supporting the growth of its employees.

Contact our dedicated electronic invoicing team to discover how we can improve your operational efficiency.

For 30 years, we’ve been facilitating collaboration and the digital transformation of businesses thanks to our DNA as integrator, host and publisher.

2024 EDT All rights reserved | Legal information